haven't filed taxes in 5 years

While the lat See more. You may be subject to interest and penalties if you owed taxes for the previous five years but your tax professional may be able to request penalty abatements and negotiate.

4 Steps If You Haven T Filed Your Taxes In A While Inc Com

If the CRA hasnt been trying to contact you for the years that you havent filed taxes consider that a good sign.

. Its too late to claim your refund for returns due more than three years ago. Have you not filed your taxes in 3 years. The first step of filing your taxes is gathering paperwork and documents.

Havent Filed Taxes in 5 Years If You Are Due a Refund. If you owed taxes for the years you havent filed the IRS has not forgotten. If you havent filed in years and the CRA has not yet contacted you about your late taxes apply to the Voluntary Disclosure Program as soon as possible.

Therefore make sure that you consult a knowledgeable tax attorney when you have years of unfiled taxes so you can be guided accordingly. Step 1 Check your status with the IRS. If you fail to file your taxes youll be assessed a failure to file.

What about not filed taxes in 10 years. Havent Filed Taxes for 5 Years. Httpsbitly3KUVoXuDid you miss the latest Ramsey Show episode.

However you can still claim your refund for any returns. What happens if I havent filed taxes in years. If youre required to file a tax return and you dont file you will have committed a crime.

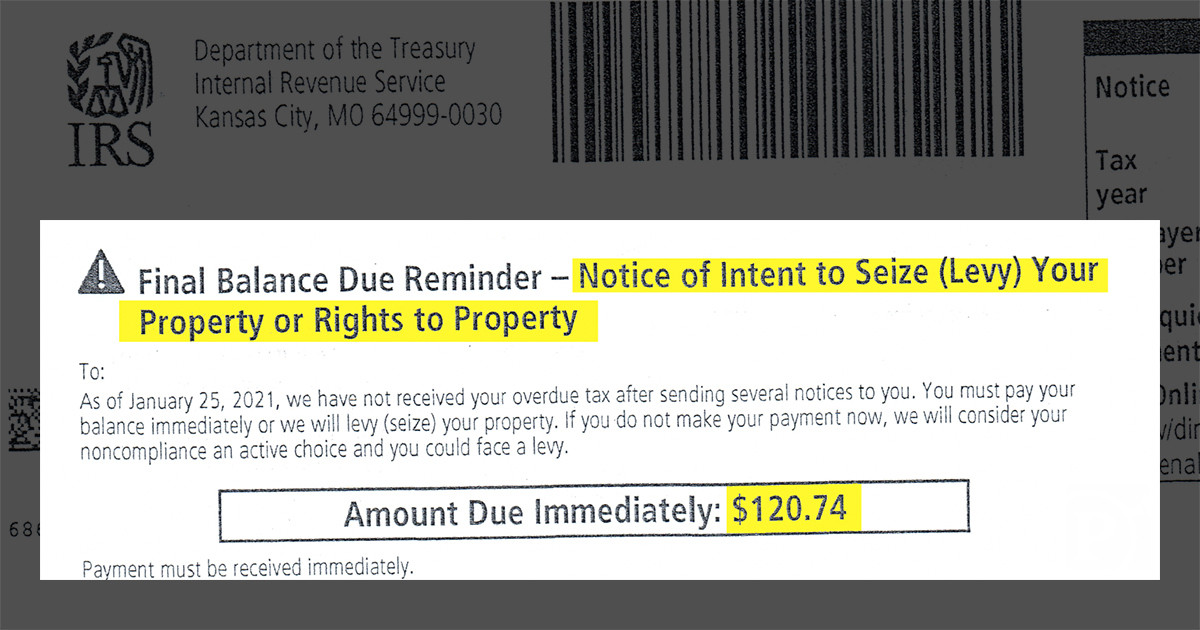

This penalty is 5 per month for each month you havent filed up to a maximum of 25 over 5. Tax not paid in full by the original due date of the return regardless of extensions of time to file may also result in the failure-to-pay penalty unless you have reasonable cause for. If you dont file your taxes the IRS will often file a Substitution for Return on your behalf.

I run through all of the scenarios. How about not filed taxes in 5 years. This penalty is usually 5 of the unpaid taxes.

415 64 votes If you fail to file your taxes youll be assessed a failure to file penalty. The criminal penalties include up to one year in prison for each year you failed to file and fines. The criminal penalties include up to one year in prison for each year you failed to file and fines up to 25000 for each year that you fail to file.

You may also face late filing penalties. But if you filed your tax return 60 days after the due date or the. While the IRS seldom uses criminal prosecution to enforce taxpayer obligations it always uses civil penalties.

The IRS expects you to file any annual tax returns that you havent filed yet. Here are the tax services we trust. In order to qualify for an IRS Tax Forgiveness Program you first have to owe the IRS at least 10000 in back taxes.

The IRS estimates what it thinks you owe. For each return that is more than 60 days past its due date they will assess a 135 minimum failure to. Weve done the legwork so you dont have to.

For every year that you did not file a tax return you should gather your W-2s or 1099 forms. That said the IRS. If the IRS elects to charge a fee it must be done within six years of the tax return due.

If you cannot find these. That said youll want to contact them as soon. This helps you avoid prosecution for.

Then you have to prove to the IRS that you dont have the means to. The penalty charge will not exceed 25 of your total taxes owed. Contact the CRA.

Keep in mind that if you owe any additional taxes for prior years once you file your returns the IRS is going to assess penalties and interest on top of the balance due. The easiest way to get started is to go to the IRS website httpswwwirsgovindividualsget-transcript and request Wage and Income Transcripts for. If you owe taxes and did not file your income tax return on time the CRA will charge you a late filing penalty of 5 of the income tax owing for that year.

These 13 Tax Breaks Can Save You Money Even If You File Last Minute Cnet

Top 5 Things To Know If You Haven T Filed Your Tax Return Yet

Irs New York State Unfiled Tax Returns Ny Tax Attorney Answers

Pix11 News On Twitter It S Tax Day The Federal Deadline For Individual Tax Filing And Payments And The Irs Expects To Receive Tens Of Millions Of Last Minute Filings Electronically And

Trying To Reach The Irs Very Few Callers Getting Through

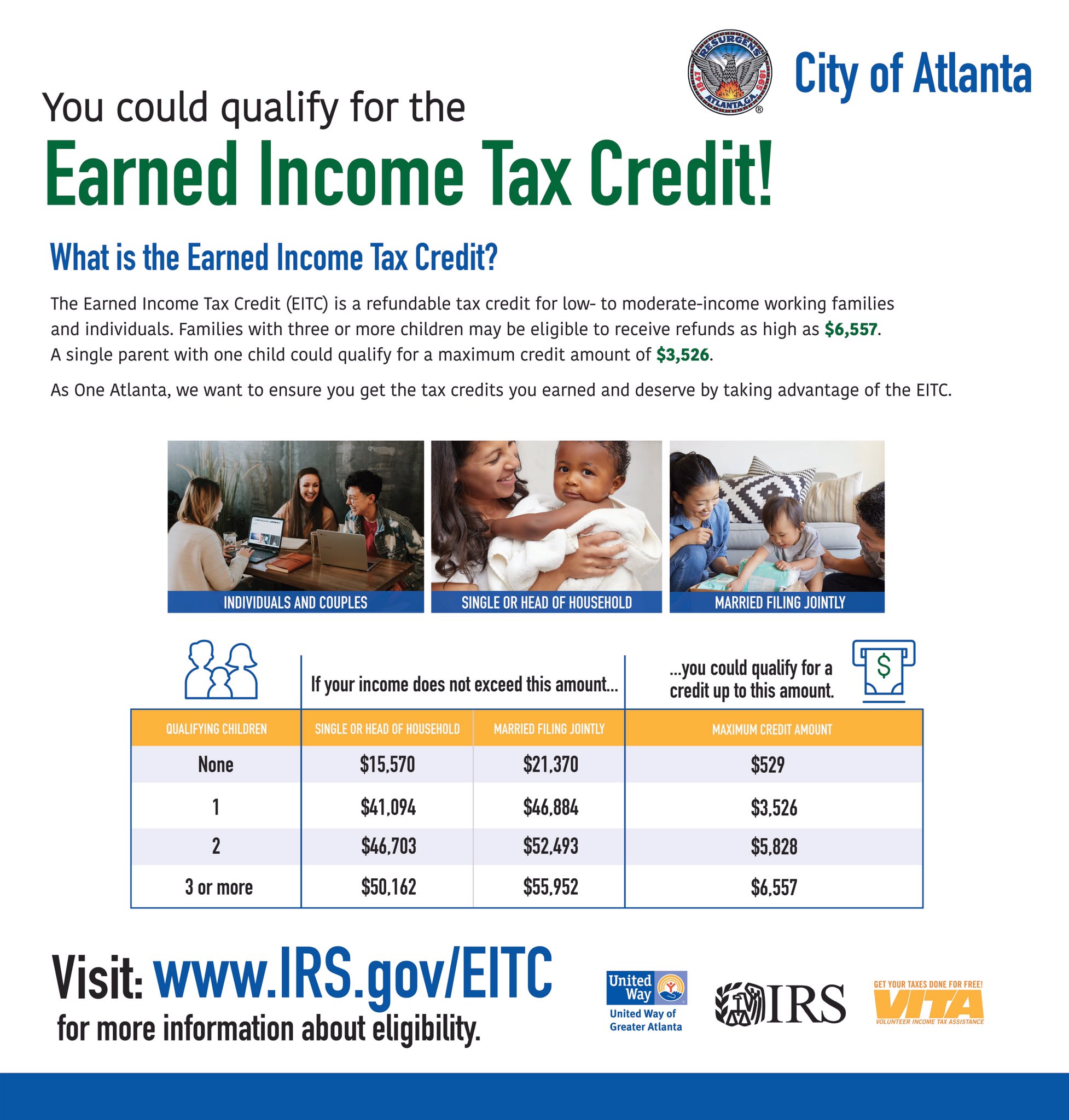

City Of Atlanta Ga On Twitter The July 15 Tax Filing Deadline Is Approaching If You Haven T Filed Your Taxes Check To See If You Qualify For The Earned Income Tax Credit

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

:max_bytes(150000):strip_icc()/when-you-haven-t-filed-tax-returns-in-a-few-years-3193355-c6f6b92413334c7284aecb6b2162b900.png)

What Happens If You Don T File Taxes

The Irs Cashed Her Check Then The Late Notices Started Coming Propublica

What Happens If I Haven T Filed Taxes In Years H R Block

5 Things To Do If You Haven T Filed Your Taxes Infographic

What Is The Penalty For Failure To File Taxes Nerdwallet

Unfiled Tax Returns Guidelines And Info On Filing Tax Returns Late

2022 Tax Day Filing For A Tax Extension Here S How That Works And When Your Taxes Are Due Nbc Chicago

It S Been A Few Years Since I Filed A Tax Return Should I Start Filing Again H R Block

Haven T Filed Taxes In Years What You Should Do Youtube

Tax Season Is Here How To Prepare In 2022 Nextadvisor With Time